The IRS (Internal Revenue Service) determines tax brackets based on a progressive tax system in the United States. This system is designed so that taxpayers with higher incomes pay a higher percentage of their income in taxes. The tax code is divided into different income ranges, called brackets, and each bracket is assigned a specific tax rate.

Tax brackets are determined and adjusted periodically by the federal government, typically based on factors such as inflation, economic conditions, and changes to tax policy. The adjustments to tax brackets are generally made annually and are based on the Consumer Price Index for All Urban Consumers (CPI-U), which helps account for inflation.

Each year, the IRS releases updated tax brackets that outline the income ranges and corresponding tax rates for individuals, married couples filing jointly, heads of households, and married couples filing separately. These tax rates are applied incrementally, meaning that as your income increases, you pay the appropriate tax rate for each income range you pass through.

Keep in mind that the tax brackets I provide below are based on my knowledge cutoff date in September 2021 and may have changed since then. For the most current tax bracket information, visit the IRS website or consult a tax professional.

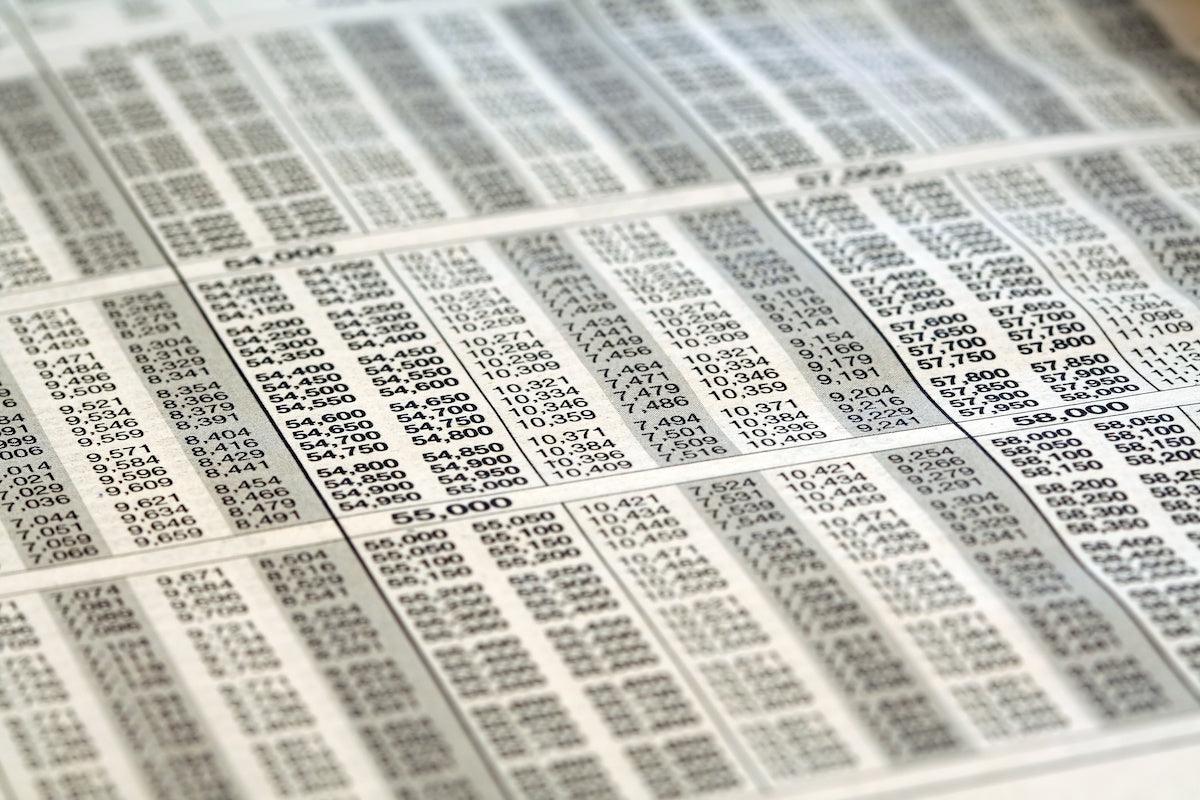

For the tax year 2022, the federal income tax brackets for single individuals were as follows

|

If taxable income is over: |

but not over: |

the tax is: |

|

$0 |

$10,275 |

10% of the amount over $0 |

|

$10,275 |

$41,775 |

$1,027.50 plus 12% of the amount over $10,275 |

|

$41,775 |

$89,075 |

$4,807.50 plus 22% of the amount over $41,775 |

|

$89,075 |

$170,050 |

$15,213.50 plus 24% of the amount over $89,075 |

|

$170,050 |

$215,950 |

$34,647.50 plus 32% of the amount over $170,050 |

|

$215,950 |

$539,900 |

$49,335.50 plus 35% of the amount over $215,950 |

|

$539,900 |

no limit |

$162,718 plus 37% of the amount over $539,900 |

Please note that these tax brackets and rates apply to federal income taxes only. State and local income taxes may have different brackets and rates.